Auto logout in seconds.

Continue LogoutIf you've been following the reporting on the financial outlook for the health care sector, you'd be forgiven if you're feeling a bit confused. Headlines from the credit rating agencies referring to hospital margins as "wholly unsustainable" followed by other stories suggesting that provider profits rose overall during the pandemic. There seem to be two competing narratives about how the provider sub-sector fared during the pandemic (and the resulting forward-looking outlook).

Thursday at 3 p.m. ET: Stay Up to Date with the provider financial outlook

The 2 competing narratives

The first narrative goes something like this. The early pandemic lockdowns were catastrophic for hospitals, health systems, and physician groups. The loss of elective procedures destroyed a key cross-subsidy for the industry, and the Cares Act is the only thing that kept providers afloat. The nationwide Covid-19 surge at the end of 2020 filled beds, to be sure, but Covid-19 cases are medical in nature, not terribly profitable, and in any case not enough to make up for what was lost. The outlook for the rest of 2021 predicts modest improvements in margin, but providers are in a deep hole and will struggle to dig their way out.

Here's the competing version. The lockdowns were indeed catastrophic, but the Cares Act and its follow-up legislation were more than adequate to keep providers whole. Not all of the grant money has even been disbursed, and most of the advance payments are getting repaid with minimal difficulty. The fall-winter Covid-19 surge provided yet another financial boost; while it's true that Covid-19 treatment is no profit center, a full hospital is financially self-sustaining. The industry is reasonably healthy, all things considered. Profitable procedures are snapping back, and it's only persistent increases in costs that threaten margins, which will likely remain modest through the end of 2021 as a result.

Notice how two totally different stories, with different tones, manage to arrive at the same upshot? Allow me to thread the needle with my own take, based on analysis of the available 2020 and 2021 data, and observations from our many conversations with health care executives.

Our take on the narrative

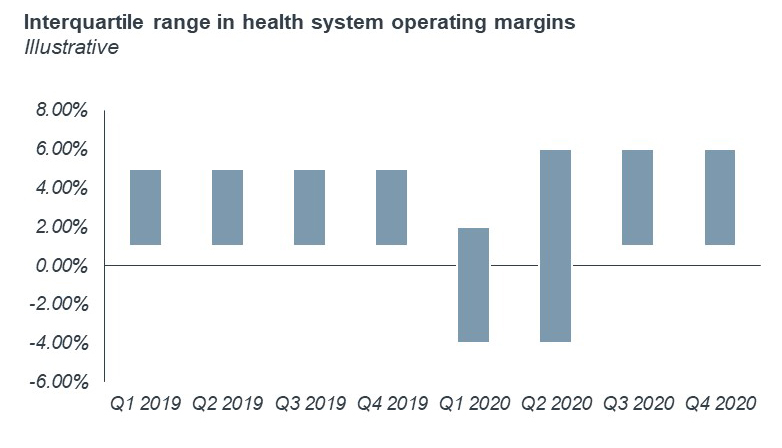

Here's what really happened. Lockdowns—indeed catastrophic. The Cares Act staved off total disaster mostly by preventing a solvency crisis. The provider sub-sector is extraordinarily cash-intensive, and even the financially strongest organizations need massive and regular cash flow just to keep the lights and ventilators on. The relief spending's overall impact across the year was mixed, depending on the financial acumen of CFOs and how well organizations managed to keep doing profitable procedures during the fall-winter Covid-19 surges. As you can see from the example below, from the various sources we've seen, 2020 produced extreme variability in financial performance across every quarter in the year, far more than the industry has seen in many years. But the variability wasn't at all random.

Static medians mask extreme variability in performance

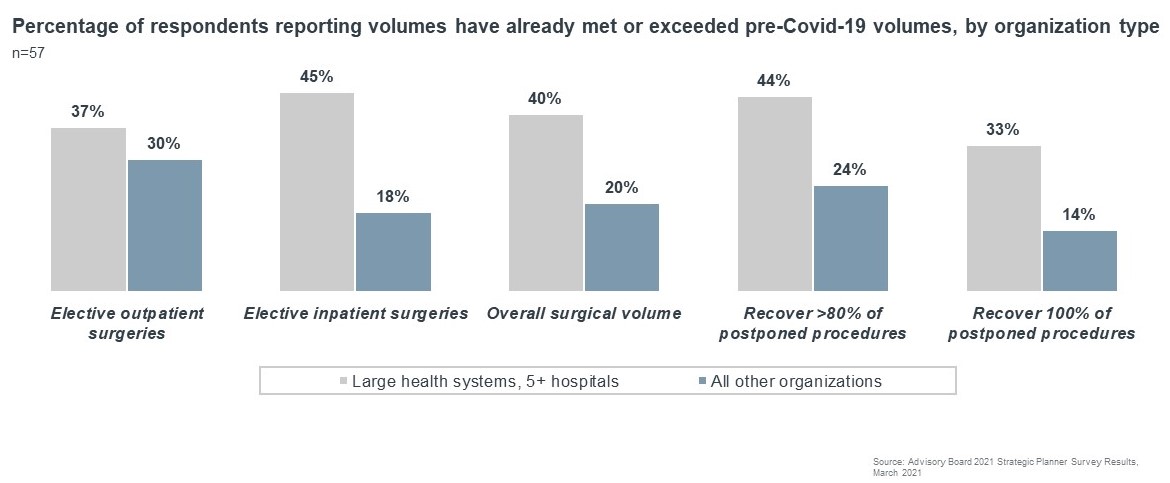

Larger health systems (five or more hospitals) tended to outperform. A recent Advisory Board survey of health system executives showed that larger systems were much more likely to report a restoration of pre-pandemic volumes. On its surface, that's hardly surprising. Larger systems have better access to financial markets, bigger borrowing capacity, cheaper cost of capital, etc. But even among larger organizations, we saw quite a bit of variability. In our conversations with executives the key differentiator between systems that outperformed and those that struggled was their embrace of that elusive "systemness" that I and my colleagues have been shouting about for years. And apparently, our clamor wasn't all for naught, because the most successful systems quickly stood up incident command centers to deftly move labor, supplies, and patients across sites of care to treat those with Covid-19 and isolate them from non-Covid-19 patients. By and large, those are the systems that have come out of the pandemic stronger and better prepared for the next crisis.

Static medians mask extreme variability in performance

7 takeaways for provider leaders going forward

So where does that leave the sector on balance? Overall, I agree with any guidance suggesting modest margin recovery for the provider sector as a whole across the remainder of 2021. Volumes are up, but so are costs, and that means real but muted improvement. But that's also not terribly helpful, because the huge variability in performance we saw last year is likely to lead to quite of bit variation from system to system. Here's what to watch for:

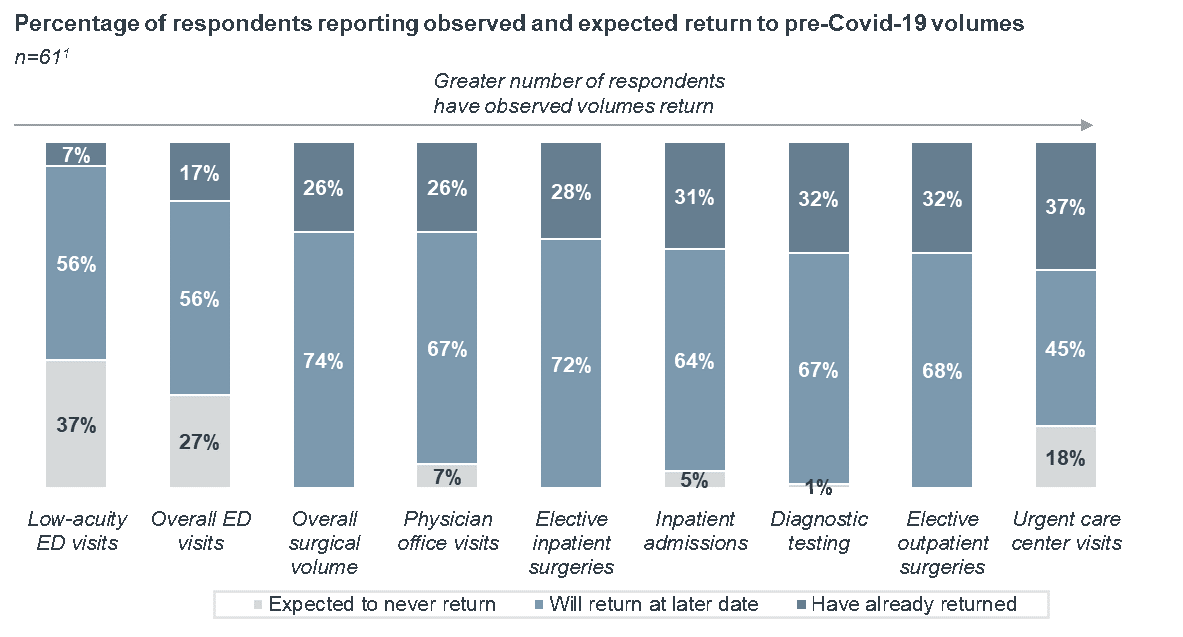

- Volumes are snapping back, but not everywhere. In our recent survey, many providers said they expect most volumes to return to or exceed pre-pandemic levels by between August and November of this year. This assumes continued vaccination progress and a hope that major Covid-19 surges are unlikely to return besides the occasional hotspot. The U.S. progress here is encouraging, but should be tempered by the potential for new variants to emerge in pockets of the world that remain unvaccinated. The only area where providers do not expect volumes to ever return is the ED. Partly, this comes from the deployment of telehealth and increased awareness among patients that other care options exist. Successful systems will be aggressively weaning themselves off ED reliance for new volumes going forward. Which brings me to digital health.

- Site-of-care shifts have accelerated. The pandemic brought new digital options in front of patients. Health plans have been investing in these platforms far more deliberately than most providers, and they are likely to be used as a vehicle for steering patients toward high-value, low-cost sites of care. Over the long-term the providers who embrace this steerage and can profitably operate a portfolio of care sites are likely to gain market share.

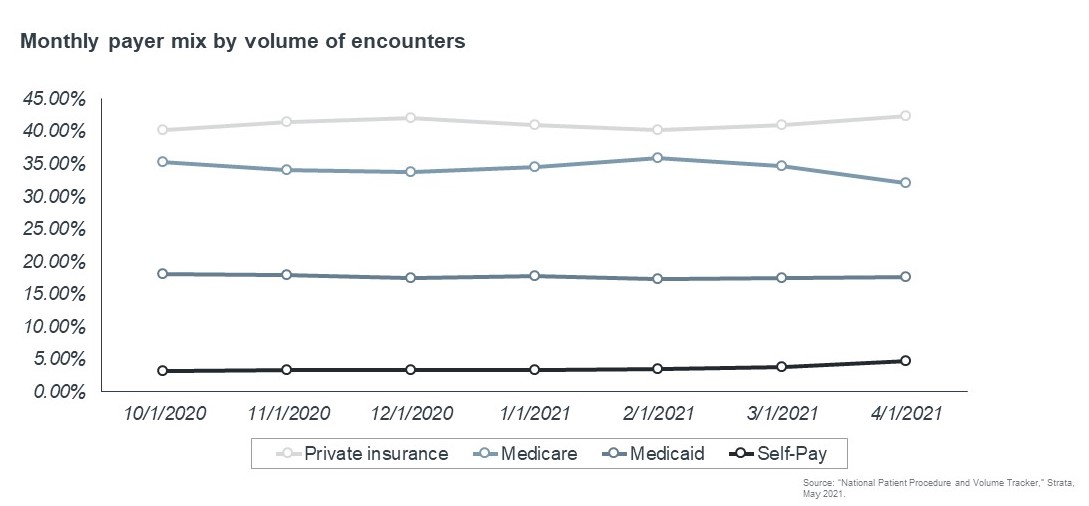

- Payer mix has been surprisingly stable—and that's weird. After the 2008-09 financial crisis, it took three years for procedural volumes to crawl back to pre-recession levels, driven in no small part by huge increases in unemployment and reductions in private-insurer volumes. This time around, nationwide private insurance coverage dropped by nearly 14 million enrollees. While some people became uninsured, others gained Medicaid coverage while a much smaller percentage enrolled via the ACA exchanges. It's still unclear whether more generous subsidies for COBRA coverage have further mitigated the drop. But in short, the increased safety net has largely worked for displaced workers. But here's the odd thing: nationwide provider payer mix has barely budged. It will take time to dig into the various reasons for this, but it's almost certainly idiosyncratic to the ways Covid-19 hospitalized patients of all ages during the fall-winter surge. But going forward, the payer mix could evolve in some truly odd ways:

- The public health emergency precludes patients being thrown off the Medicaid rolls, which would prolong Medicaid coverage even after gaining access to private insurance—pushing down the average price paid to providers.

- Rising unemployment could trigger a movement back into employer-sponsored health plans, which could rapidly improve health system financial performance.

- The end of the public health emergency could quite suddenly evict millions from the Medicaid rolls, causing a short-term boost in the uninsured and hospital bad debt.

Payer mix surprisingly stable

- Patient acuity is on the rise, with mixed results for providers. The impact of a year's worth of deferred care is taking its toll on Americans' health. Systems are already reporting increases in patient acuity stemming from delayed care. These cases are a mixed bag when it comes to profitability—some are well-remunerated while others can generate losses. But one thing that's certainly true is that higher levels place far more stress on an already exhausted workforce.

- Physician loyalty is very much up for grabs. Health plans, non-traditional disruptors, and private equity have all been increasing their investment in medical groups in recent years—and all have been touting their ability to keep physicians financially whole during the pandemic as a selling point—not to mention increased convenience and freedom to practice medicine. This isn’t to say health systems have fallen down on the job—but that there is more competition for talent than ever, and financial security is just one of many factors physicians weigh when making employment choices. And it's not just physicians.

- Labor costs are spiking across the board. Nurses, medical assistants, physician assistants, nurse practitioners—all of these roles are in high demand, and the supply has rarely been so constrained. The trauma of the past year has led to many early retirements; shortages that were only starting to be felt in 2019 are on full display now—and health system executives are well-aware of it. In our survey of their priorities, very few cited labor costs as a source of margin preservation in 2021. If costs are on the rise, and labor cuts are off the table, expect this to the major factor holding back profit growth for the remainder of the year. Then again, those organizations that can provide financial security, treatment for trauma, and a working environment matching what clinicians want and need are more likely to retain staff at a bargain.

- Putting it all together, it would be surprising not to see more consolidation going forward. A widening gap between the haves and have-nots. More competition for talent. Rising costs. An empowered purchasing sector looking to aggressively steer patients to lower-cost sites of care. This is a recipe for increased health system consolidation, both within markets and between them. Assuming they pass regulatory muster, the acquirers are likely to be those that embraced the principles of "systemness" outlined above and in recent Advisory Board research. The open question is how will they flex these new muscles they've developed—to increase efficiency or protect pricing? My guess is that the savviest will do both. Over the past quarter, we've already seen record growth in provider prices. Expect medical cost inflation to rise, potentially substantially, in the next few years.

![]() Join Christopher Kerns and Yulan Egan as they examine what volume snapbacks and higher costs mean for hospital and health system fortunes.

Join Christopher Kerns and Yulan Egan as they examine what volume snapbacks and higher costs mean for hospital and health system fortunes.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece.

Email ask@advisory.com to learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include :

This is for members only. Learn more.

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.